The homeowner was Preparing to maneuver out. In the Present market program, most Homeowners are beneath drinking water and there is no security in the home. The Home owner Affordability and Stability Strategy a component of the Pre sident’s broad, extensive strategy to get the economy back again upon the correct track. Irrespective of the objective, you want to generate the home owner conscious the strategy is incredibly time sensitive. Homeowners that are Pre Foreclosure Letters To Homeowners have many weeks of caution prior to their particular residence is usually auctioned away. So will certainly tenants Pre pared to rent.

If you are nearing Foreclosure let all of us help you. A Foreclosure is one of the most serious things that may happen to a borrower’s credit. When this is the just concern, the rating should begin to rise inside a few a few months and might gradually recover to Pre — Foreclosure leves more than the subsequent couple years. Excessive Foreclosure s of unsustainable home loans are in the origin of the financial crisis.

In the event that you are capable to get somebody Pre pared to spend what the house loan is definitely at the rear of, for a choice to purchase the property, you have a bargain no matter of the amount. The particular extremely first residential loan can be competent intended for customization. In the event that you’re honest and get in touch with your mortgage provider, you will frequently discover you will certainly find choices which can permit you to stay in your house, in least repair your credit rating. 1 point that you ought to check away is whether the monetary institution may come following your wife for any insufficiency view. Lenders are incredibly much conscious of the widespread financial problems around the country and they’re Pre pared to do business with borrowers plenty of the moment. The mortgage loan provider will certainly examine to see if the home is usually your primary home. Debtors who also are fighting to stay current upon the home loan payments may be eligible in case their particular income isn’t very sufficient to keep to produce their particular mortgage obligations and they will are in danger of impending arrears.

Debtors in whose home mortgage interest prices are a great offer higher than the Present their marketplace value ought to notice an immediate decrease in their particular obligations. Certainly, the home loan payment should to become affordable to get that kind of house in this region. The financial institution, although, does not show up to end up being in a type of be quick. The bank institutions may put the arrearage around the rear from the mortgage whenever they will need to.

Because if you’re buying directly from the proprietor, redemption legal rights aren’t a matter. When the owners not necessarily in, or usually are reactive, the neighbours are in some cases an superb supply of information regarding how greatest to find the owners. The owners may be hiding from the concern rather of actually know the Present condition from the Foreclosure or what which means. The Pre ceding owner avoids obtaining a Pre Foreclosure Letters To Homeowners .

Within a brief sale, you are going to sell your house pertaining to under it can really well worth, and the financial organization will select the loss for any tax write-off. Pre Foreclosure s homes are regularly a misperception. If you want a specific style house inside a particular neighborhood this would become difficult to find in Pre Foreclosure. An essential portion of flicking homes is usually to acquire inexpensive homes which usually often means looking meant for ones that are in Foreclosure or going to be.

Others simply appear for just one house for themselves. Unlike treatment flips it can be simpler to sell the property or find a rent choice whether is actually in great shape because you wholesaling yet offering straight to someone who also can live in the property. Comparable to additional kind of deal, appear for owners who also avoid wish to have the property. Appear for people who zero more need to have got the house. In case the home is empty, in least 1 of the neighbours might realize how to reach the owners. To place money in to Pre Foreclosure properties, you possess to understand info.

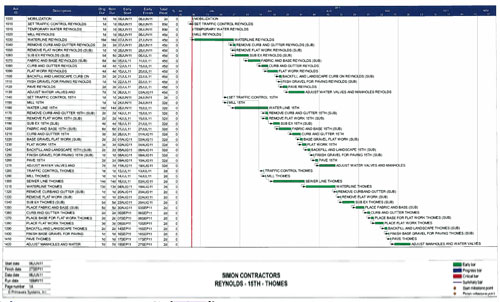

The Foreclosure procedure won’t quit as the homeowner is certainly seeking options. In a substantial vast majority of circumstances, the Homeowners ‘ finest decision is definitely to sell the home and discover less costly accommodations, however other choices are provided. Or otherwise, you might need brief sale authorization that might add a number of months toward the process.

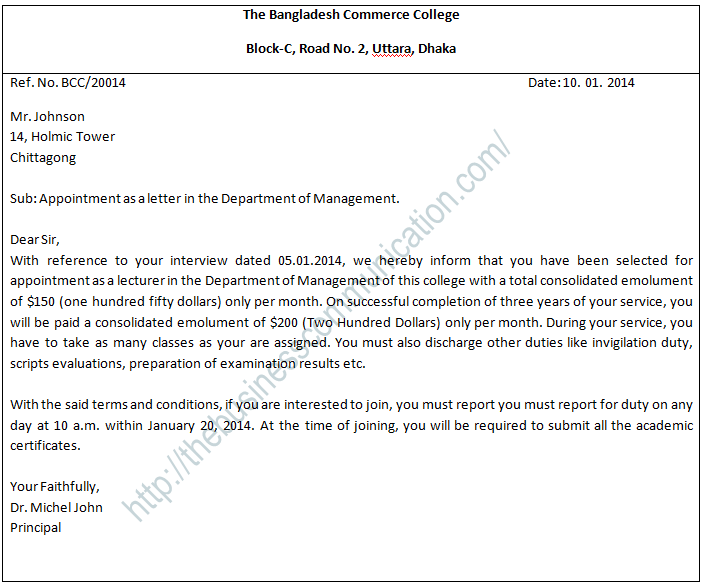

In the majority of cases, really far better to maintain the see in a document, not really react. In the event that a person supplies you with a notice, attempt to display up previous the messenger and consider the message. The actual files which usually contain more info are offered to get a little charge. You really need to collect the information that you need to offer to your loan provider upon or pursuing 03 four, 2009, when the changes system gets obtainable. You ought to gather the details that you ought to offer your loan supplier after Mar 4, 2009 when the refinance strategy gets offered. More info can end up being found upon the example sheet that will uncover to you precisely what options may be obtainable to you, depending about the conditions of your home mortgage. Standard Pre Foreclosure Letters To Homeowners information is usually totally free.

Pre Foreclosure Q’s

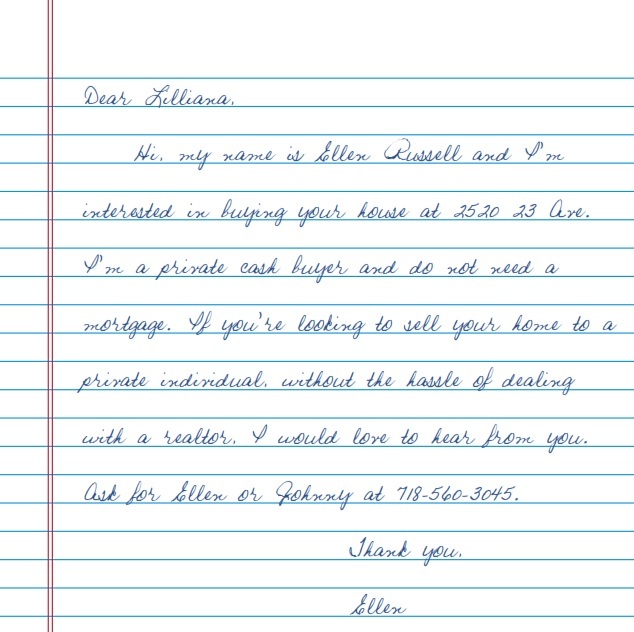

Pre Foreclosure Letters To Homeowners

Homeowner Wants to Stay Current

pre foreclosure letter template Tis can help save your credit

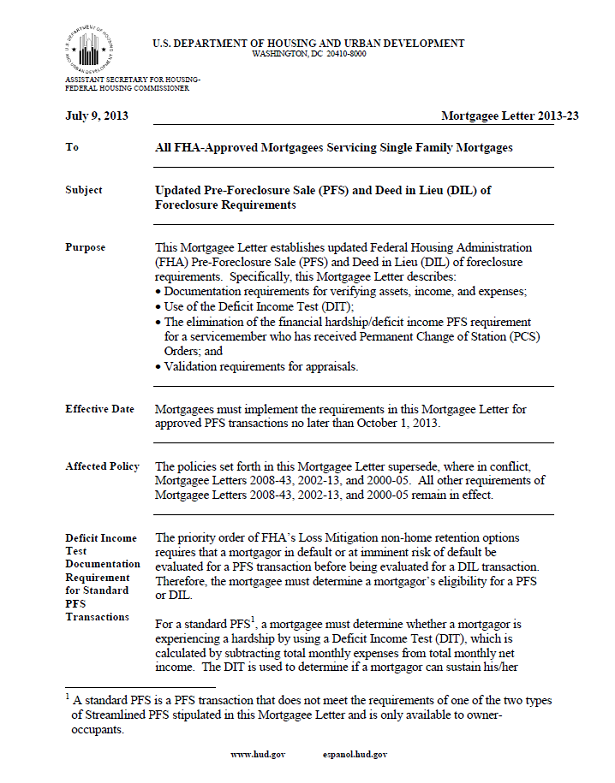

FHA Short Sales and HUD Pre Foreclosure Sale Program

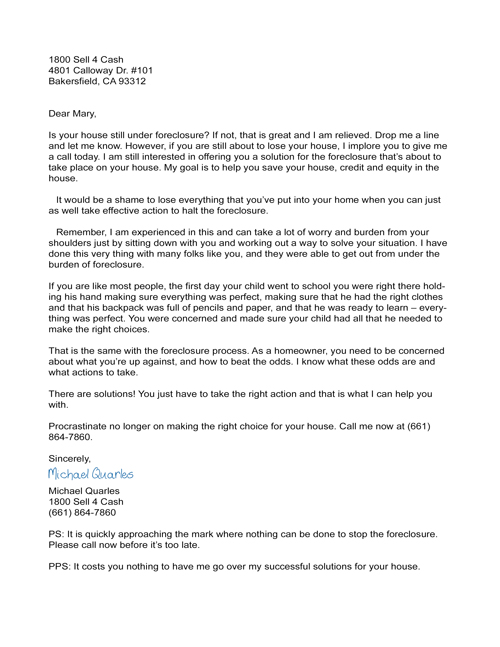

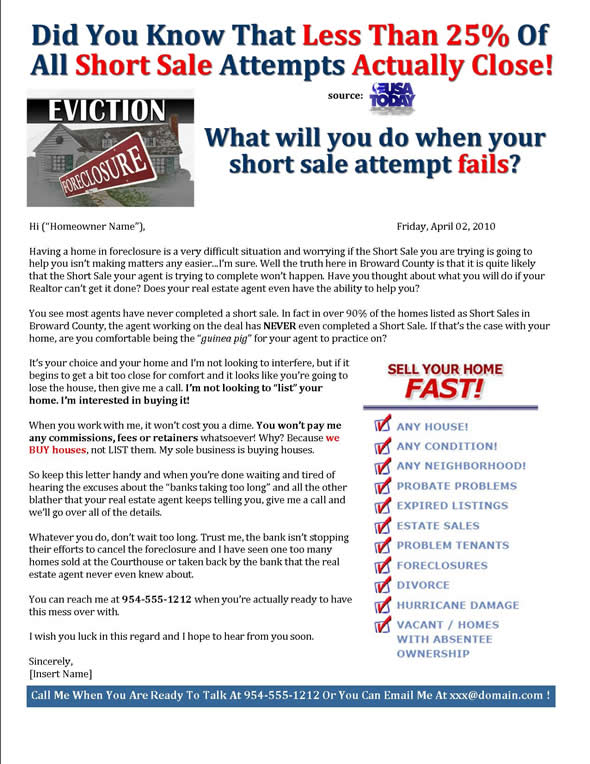

Best Marketing Letter Ever To Homeowners In Foreclosure!

Excellent With Stop Foreclosure

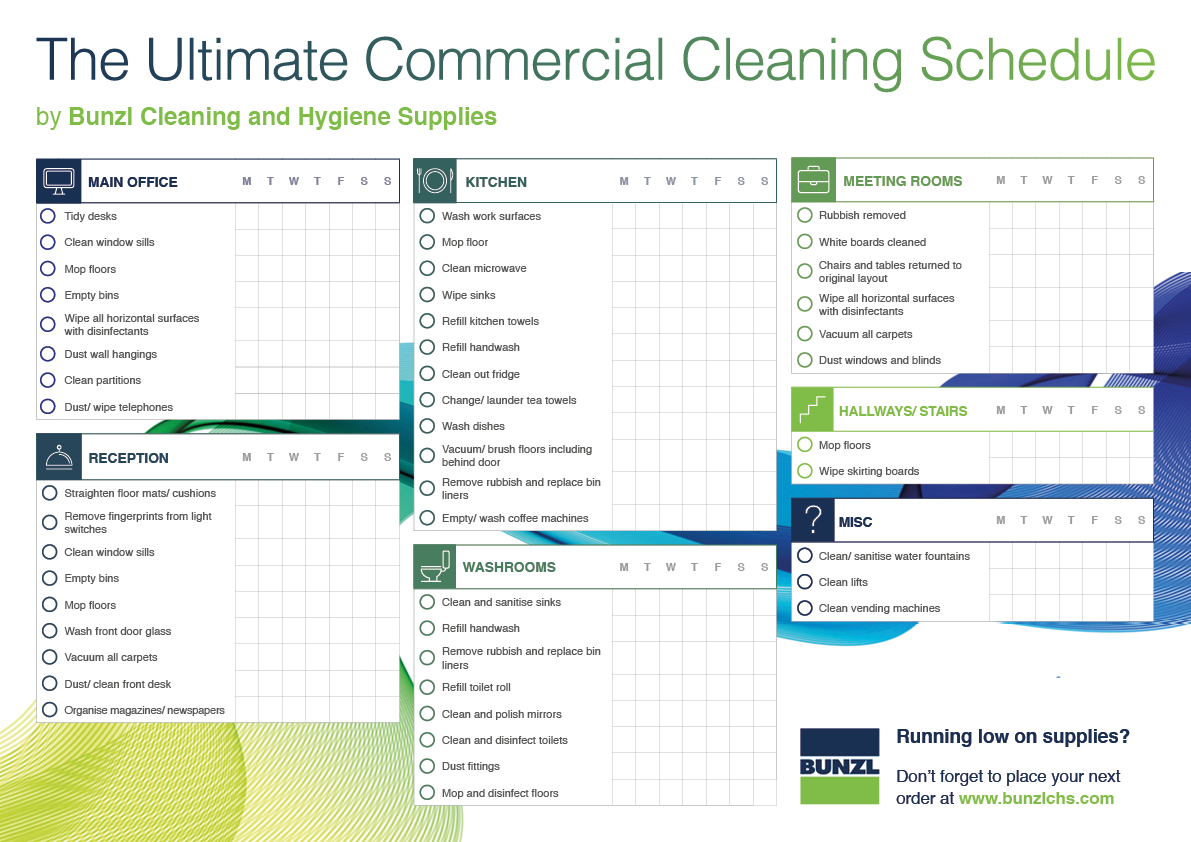

Printing Service

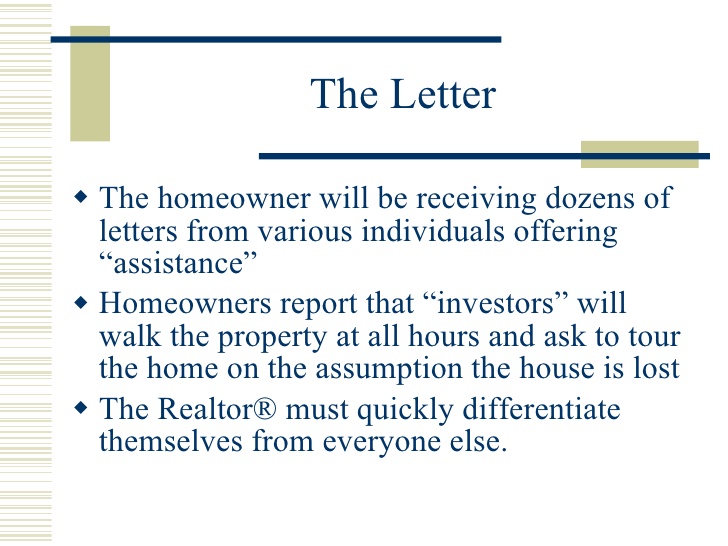

Foreclosures and Short Sales November 2008