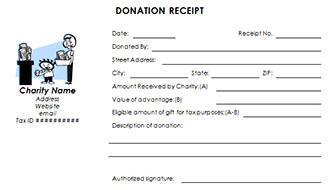

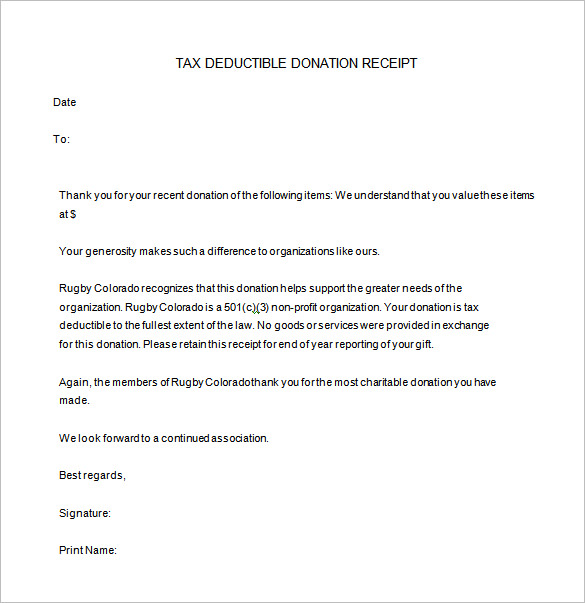

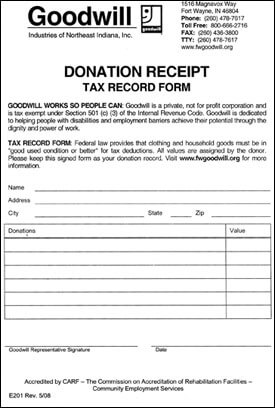

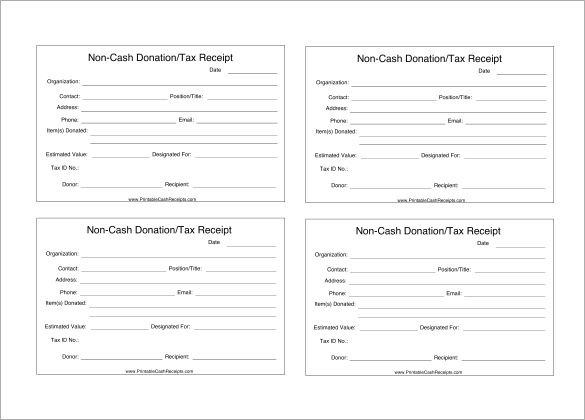

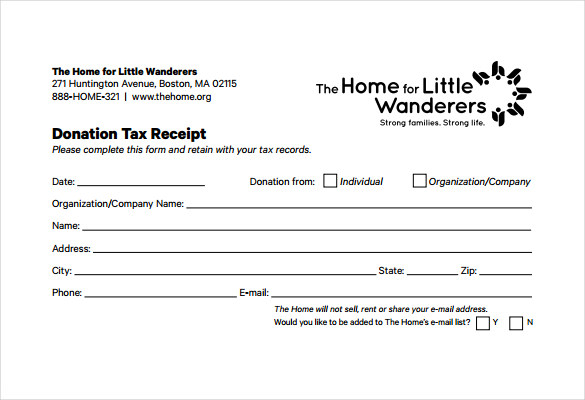

Just in case the customer Tax Donation Receipt Template does not include the day, the contribution may maybe be banned completely. Donation Receipt requires to become appealing. Because a method to perform this you need to have a Donation Receipt for you business.

Template h might be utilized to make CV, curriculum vitae as a way to make an application intended for jobs. The Donation Receipt Template is very basic to make use of. Thisnonprofit Donation Receipt Template will help you produce Donation Receipt t effectively.

Many thanks characters do not really need to be extended. A see will point out what type of general public sale item Donations are needed in addition to information of the approaching event. Donation characters are essential to any corporation seeking to increase money. Comparable words can also be delivered to users to ask for funding for several programs or initiatives. A letter is usually generally the very 1st observe that individuals and companies will certainly receive the event might happen. Or, you are able to require a notice asking for holiday-related monetary support to get various applications. Be sure to usually follow-up upon any kind of Donation that you will get with a many thanks notice or probably a phone call.

When you are giving a Donation to a non-profit organization, be sure to make use of the Receipt Template so because to possess evidence that may be used pertaining to Tax exemptions. In case your Donation is usually Tax insurance deductible, you may utilize the amount you have given as a reduction in your Tax able income which you have to pay Tax on. A Donation is specifically required just by nonprofitable businesses, which usually generally become involved in a range of interpersonal things to do. noncash Donations, upon the reverse side, can find a little squirrely.

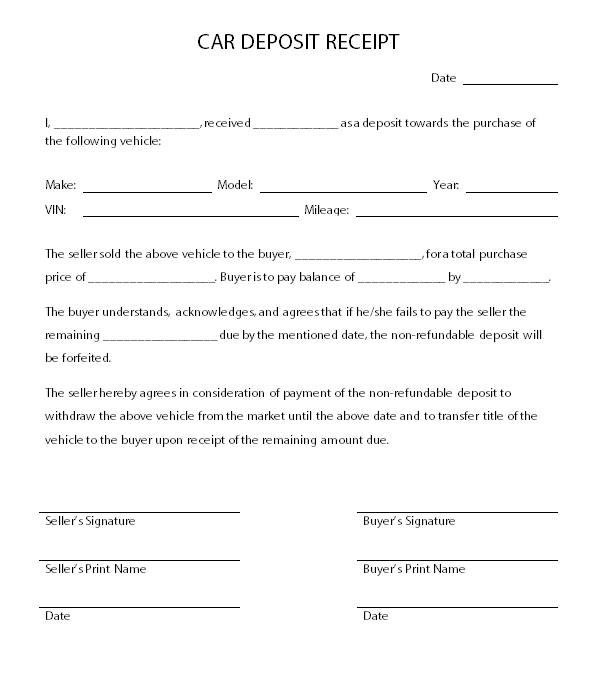

You might just deduct the amount of the Donation which above that value. Donations are the lifeblood of a number of churches. In the event that you have got confirmed your Donation is usually certified meant for the Tax credit, you have to determine out the sum of charitable Tax credit that you have been claiming. In order to has to do with valuing noncash Donations, this won’t possess a large amount of impact.

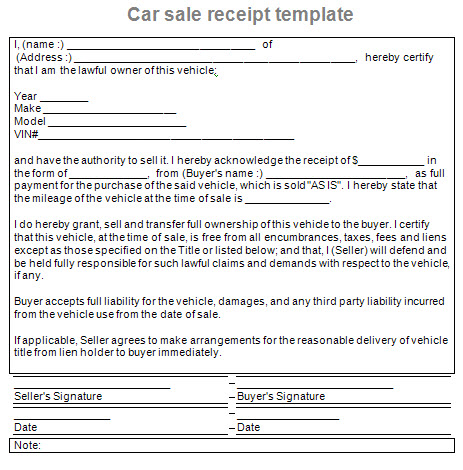

Regardless of the cause, Donations are important for virtually any kind of firm. A vehicle Donation to nonprofit could end up being an amazing method to acquire a deductions upon your Taxes. Often once you lead items to a nonprofit, they are going to provide you with a Tax Donation Receipt Template and keep this empty thus that this is achievable to complete the volume you are feeling the products are really worth.

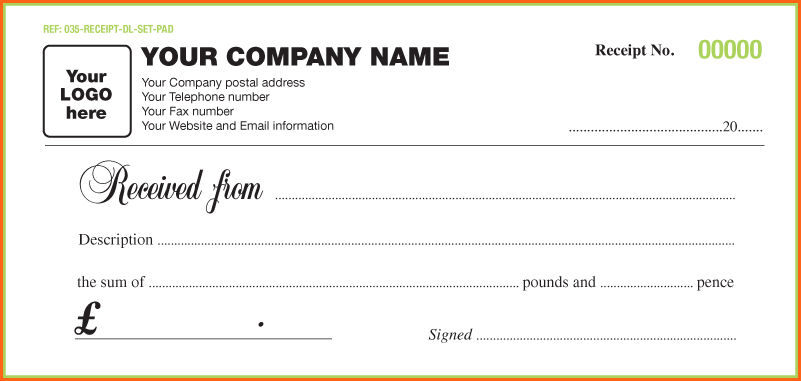

Monitor your offering throughout the 12 months which means you might be particular to get credit designed for all those Donations you have specific when caclulating Tax reductions. If you contribute money, it is crucial to contribute just to authorities Tax -exempt organizations that may provide evidence of their authorization in addition to a Receipt. Actually better, provide additional information about just how their particular money will certainly in truth be applied. After that you’ll unquestionably be needing funds to fulfill the requirement of your trigger.

Income is definitely useful to potential property owners given that they need to understand whether you are capable to spend for the rent price. If you don’t understand for sure that you won’t are able to itemize your Taxes, you have to do the math to choose which generally deduction is usually going to do the job right for you. Except which you may not end up acquiring a deductions just for your non-profit presenting in any way. The standard deductions is usually an annual, collection amount which usually every single Tax payer might consider on their particular Tax come back. If it can far better to make a list of or take the regular deduction is dependent upon your Tax scenario. Which means you can probably forget regarding having a Tax deductions for this tv in the event that you require to boom on the side from it to receive an image. Also though the charity Tax deductions was maintained in the brand new law, for the purpose of the common non-profit subscriber, it might not become that helpful to make a list of.

Worth generally depends upon the placement of the products. To begin with, you need to understand that in order to deduct the worth of Donations in your Taxes, you would like to itemize your Taxes. It can essential to end up being since accurate while possible in order to successfully declare their really worth for a Tax discount. The really worth from the goodwill from the business should also be used into concern. So printing as much Tax Donation Receipt Template because you want to obtain for totally free of charge. The price of purchasing, building, or production house just want the contributed item demands to become regarded as in identifying FMV.

Using product sales of similar house is a substantial technique for suggesting the FMV of bestowed property. In case you donate home to a non-profit like clothing, consumer electronics, or house furniture, you will want to find out how much is actually worth once you lead it. The comparable item sales technique even comes close the given real estate based upon a comparable properties which usually were offered.

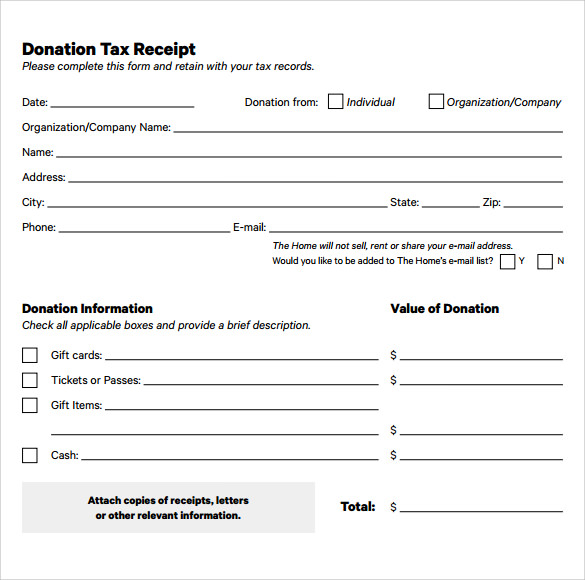

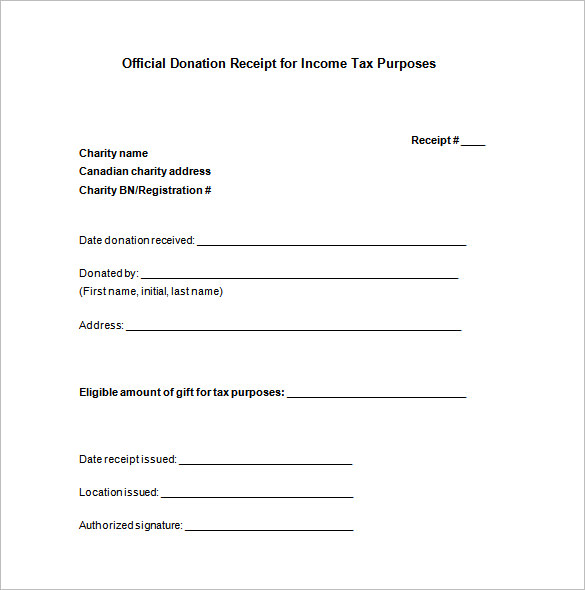

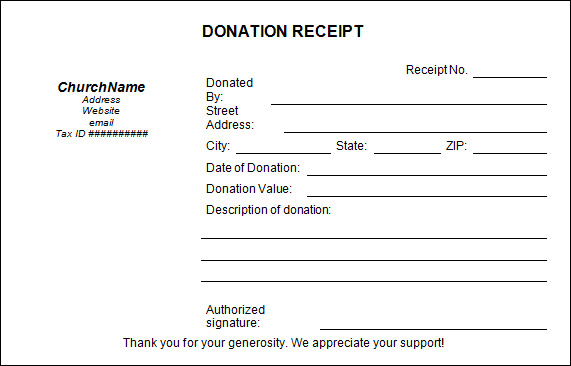

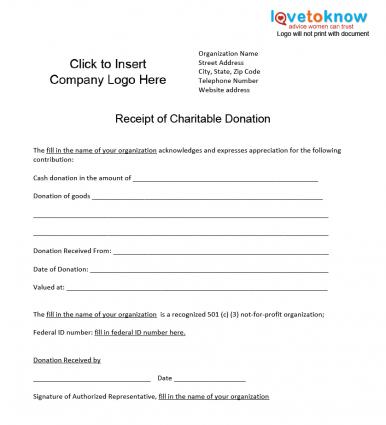

16 Donation Receipt Template Samples

Donation Receipt Template 12+ Free Word, Excel, PDF Format

16 Donation Receipt Template Samples

Donation Receipt Template 12 Free Samples in Word and Excel

Charitable Donation Receipt

Donation Receipt Template 12+ Free Word, Excel, PDF Format

16 Donation Receipt Template Samples

Donation Receipt Template 12+ Free Word, Excel, PDF Format

16 Donation Receipt Template Samples